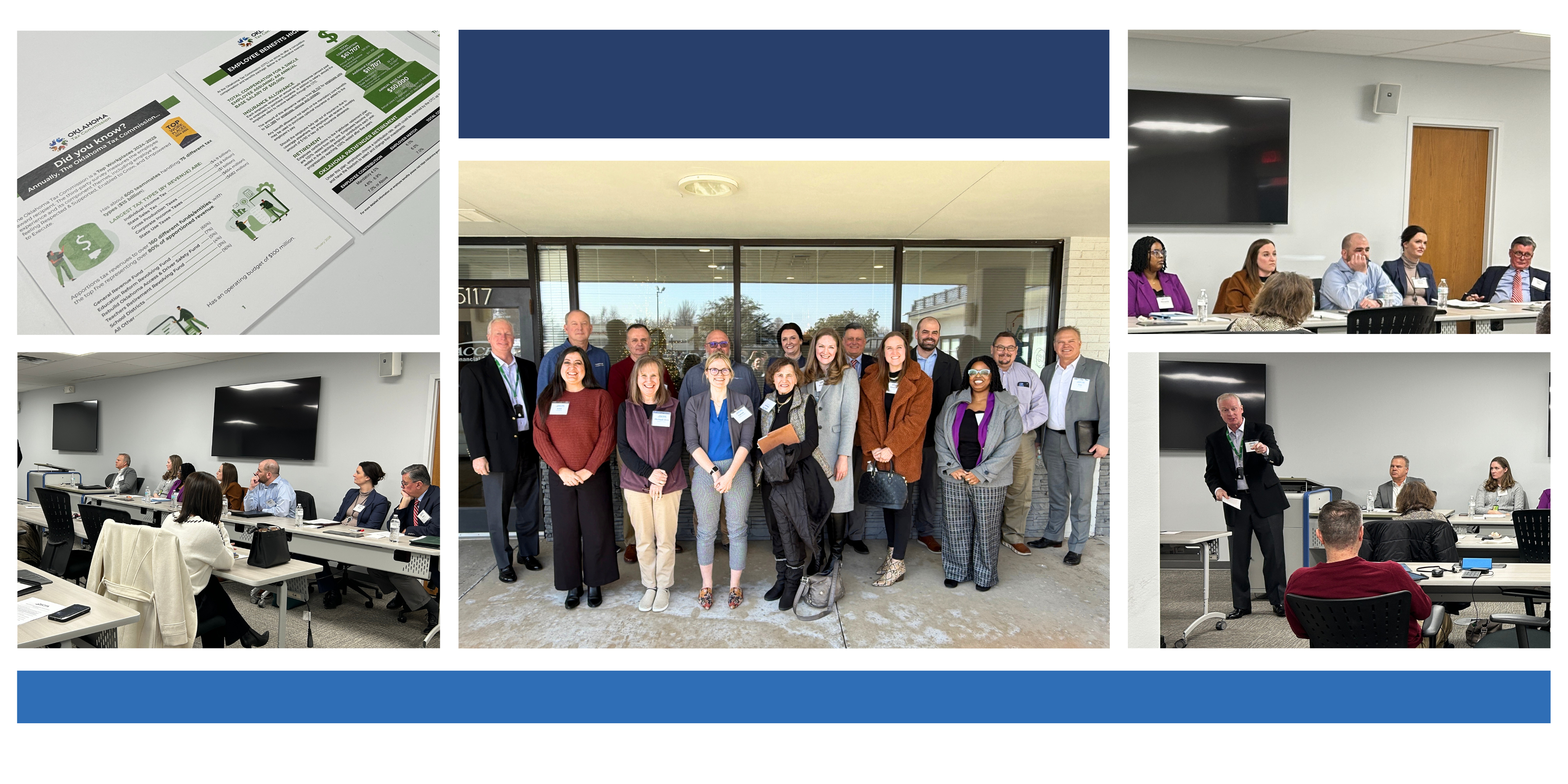

2026 OTC & Tax Committee Forum Recap

February 05, 2026

The OSCPA's Tax Committee held its annual joint meeting with the Oklahoma Tax Commission (OTC) recently to go over upcoming changes and procedures that could affect CPAs, their practices, and their clients.

During the meeting, members of the OSCPA Tax Committee and CPAs from across the state submitted questions to the Commission. The OTC provided guidance and answers that can help CPAs prepare for the 2026 tax season.

Discussion topics included letters and correspondence, amended returns and processing delays, and other key tax issues. The full Q&A is available is now available for download.

OSCPA Tax Committee members continue to dedicate their efforts to supporting CPAs by offering resources, hosting events, and organizing forums with key agencies like the OTC.

If you’re interested in getting involved, you can learn more about the OSCPA Tax Committee or sign up to volunteer on another OSCPA committee.

You can also follow the latest tax updates and share questions in OSCPA's online community, Connect. Committee members and other OSCPA professionals frequently post insights and tax updates that may impact our members.